Uptime Institute has announced the release of its 13th Annual Global Data Center survey. The findings show data centre operators facing stricter regulations and more pressure to reduce energy, along with persistent staffing and supply chain issues.

The report shows new technologies potentially presenting a promising way forward, but these often are found lacking in standardisation and scalability. While for many organisations, investments in efficiency and resiliency are beginning to pay off, progress has been gradual.

“Our data shows operators grappling with several issues,” said Andy Lawrence, Executive Director, Uptime Intelligence. “In 2023, the lingering effects of the COVID-19 pandemic have receded but other challenges have emerged. Digital infrastructure managers are now most concerned with improving energy performance and dealing with staffing shortfalls, while government regulations aimed at improving data centre sustainability and visibility are beginning to require attention, investment and action.”

Uptime’s Annual Global Data Center survey is the largest, most comprehensive and longest-running study in the digital infrastructure sector. It provides detailed insights into the digital infrastructure landscape and a view into its future trajectory.

Key findings from the 2023 report include:

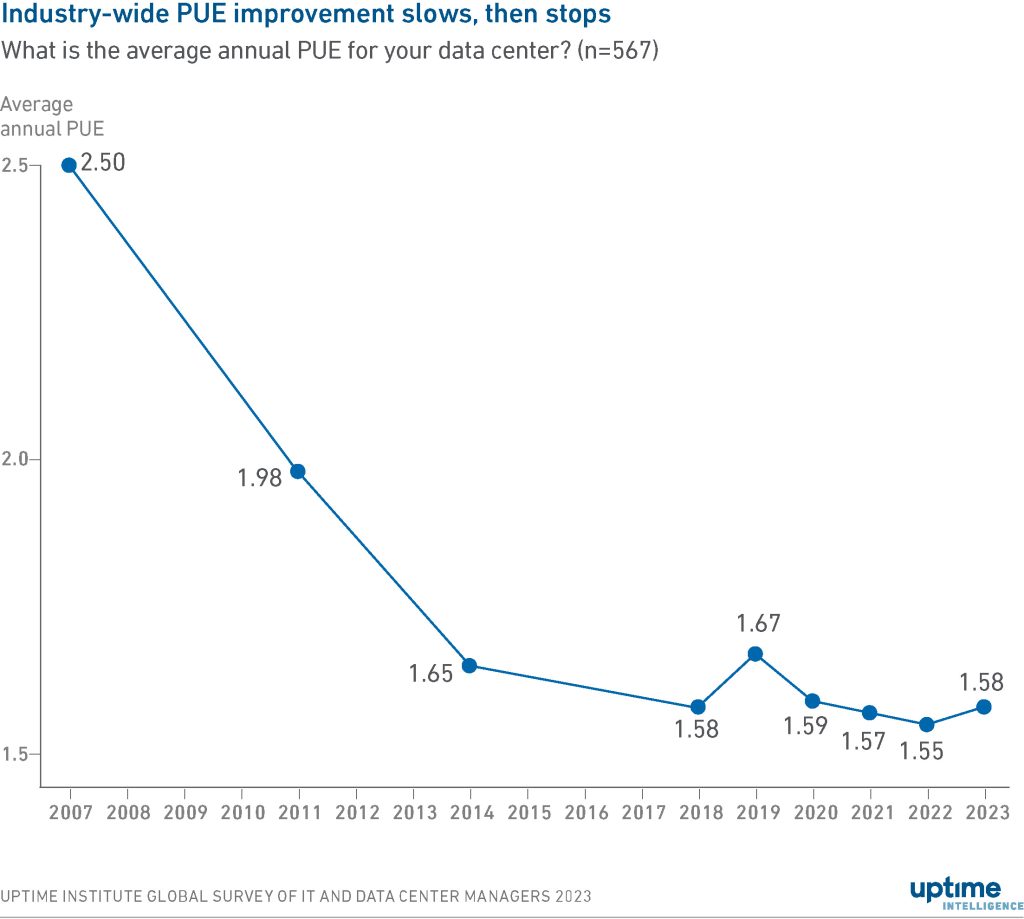

- Average global Power Usage Effectiveness (PUE) levels have remained flat for four years. Additional improvements in PUE levels will require significant investment.

- As more organisations opt for a hybrid approach to IT, the share of enterprise workloads that are run in corporate, on-premises facilities has fallen to below half for the first time and is expected to shrink further.

- Enterprise operators say data security is the biggest impediment to moving mission-critical workloads to the public cloud. Resiliency and transparency are lesser concerns.

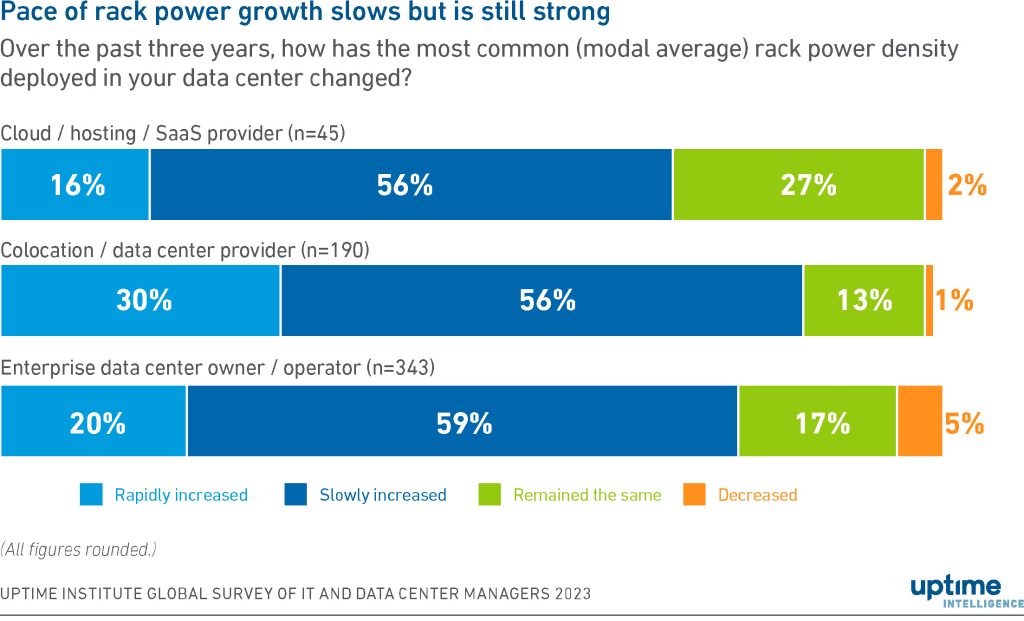

- Server rack densities are climbing steadily, but slowly. Average rack densities are below 6kW per rack; most operators do not have any racks beyond 20kW. This suggests the widespread use of direct liquid cooling is not imminent.

- Many operators only collect a limited amount of sustainability-related data and will struggle to meet emerging sustainability reporting requirements, or in turn, the requirements of some customers and the public.

Outages:

- More than half (55%) of operators reported they have had an outage at their site in the past three years, the lowest number yet recorded. This continues a trend of steady improvement.

- Power outages continue to be cited as the single biggest cause of outages.

Staffing:

- Uptime Intelligence data shows that approximately 8% of the data centre workforce are women. In the US (if not all countries), this rate is below that of other male-dominated industries, such as mining and construction.

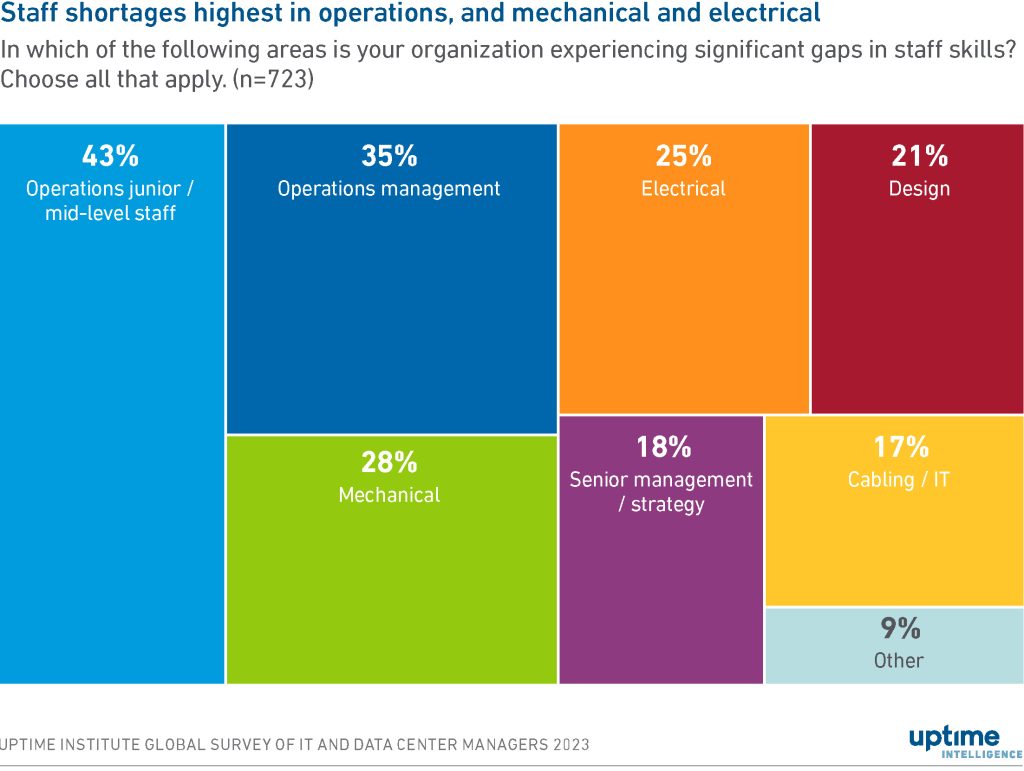

- Nearly two-thirds of operators have problems recruiting or retaining staff – however, this figure is not currently growing. The largest skill gaps are in operations, mechanical and electrical roles.